Introduction

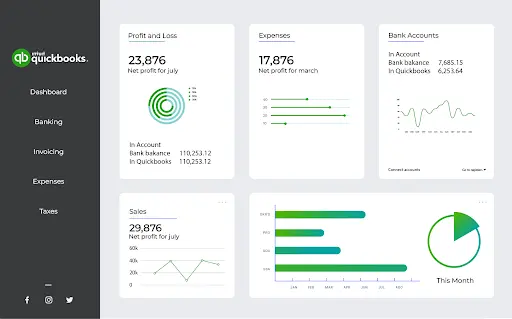

QuickBooks is the best friend for business to streamline their accounting processes. It’s used actively by CPAs, SMBs, individuals, and accountants in general. The features in the software make the tiresome accounting procedure simple and accessible.

With this convenience comes comfort. And with this added comfort, people tend to make mistakes. Although QuickBooks is easy-to-use, it still requires great attention to detail. Small mistakes can mess up your records and lead to faulty results and statements.

This creates the subconscious fear of getting things wrong in your latest QuickBooks Desktop Pro Plus software. The new and upgraded version has made things more efficient for its users, but that doesn’t mean you can disregard human error.

The new version takes a little getting used to. But it’s highly efficient when you learn to avoid mistakes. To steepen up your entire learning curve, we’ve listed down 5 mistakes QuickBooks accountants make when working with the software.

With this post, you’ll know what to avoid and how to work around problems in QuickBooks Desktop Pro Plus. You’ll save yourself some expensive mistakes with this informative list.

Avoid these 5 mistakes to master QuickBooks

These are the reasons most businesses have to redo their financial statements and records. With this knowledge in place, you’ll avoid a ton of hassle and save a lot of money.

1. No reconciliation of Bank Accounts

Your actual bank account balance should match the amount recorded in your books. Reconciling is actively checking and making sure the two match at all times. With your QuickBooks accounts, you should regularly check the accuracy of the reality and records.

In accounting, one small mistake keeps adding up and stretching out to the periods after it, leading to a statement that is far cry from the actual financial condition. Consequently, QuickBooks can depict erroneous results if your account is not reconciled at all.

Reconciliation increases the integrity and precision of your books of accounts. SMBs sit on a stronger footing when their accounts undergo regular reconciliation. It’s important for the accuracy of your financial statements.

2. Missing or omitting transactions

Don’t put things for later. It’s incredibly common to forget to record transactions. Whether it’s a meager payment for inventory or a consumer’s part payment, it’s important to record all payments and receipts.

There is consistent inflow and outflow of cash in a business. To be on track, your QuickBooks account has to be kept up to date with the smallest of transactions. While they may seem unimportant, disregarding them will lead to faulty books of accounts.

Moreover, the omissions accumulate over time and deviate from the real financial position by miles. This can further impact your business’s profitability or tax statements.

The idea here is to smartly segregate the expenditure and receipts under different relevant accounting heads to keep things organized.

3. Using the wrong report settings

QuickBooks’ default setting is set to use the accrual basis of reporting. But you may not want to use the same accrual basis for your accounting.

On an accrual basis, the transactions are recorded for revenues when they are earned and expenditures when they are incurred. The money does not have to be disbursed or received to be fit for recording in an accrual report.

However, Cash-Basis accounting records and accounts for transactions when the money is disbursed or received in the business. This is a more raw reporting feature and gives you the time for when the transaction took place, and how much cash you have in the bank.

Smaller and newer businesses should rather go for the cash basis of reporting for their accounting books. You can change your preferences by following these steps:

- Head to Edit and then Preferences

- Move on to Reports and Graphs

- Click on Company Preferences to make the changes

4. Mixed-up Chart of Accounts

QuickBooks offers you a Chart of Accounts (CoA). It’s a list of categories to record and group your various transactions like income, assets, liabilities, capital or operating expenditure. It’s a vibrant tool, but accountants and businesses tend to mess it up.

To keep things simple, and organized and avoid problems, it’s imperative that you maintain a well-distributed and arranged CoA. If it becomes jumbled up or too complicated to comprehend, you will end up with a faulty bank record.

Neither should you go overboard with the categories nor generalize transactions. The goal here is to keep things simple and streamlined. If used correctly, CoA is an incredibly useful feature of QuickBooks. But it can also complicate things for your CPA, who’ll have to redo the entire process and re-enter all records.

5. Not using backups

Accounting Data in QuickBooks account is precious to a business. A loss of data owed to a breach or technical deficiency is not how you would want to go down. Your financial records is sensitive information. If you lose these numbers in space, you might not even be able to restore them accurately, hampering your company’s rapport and growth vehemently.

You need to have a safety net. Stay prepared for the worst. An amazing way to safeguard your QuickBooks data is to back it up daily on the QuickBooks Desktop Pro Plus. To do so you will need to:

- Go to Files

- Navigate to Backup Company

- Click on Create Local Backup

Here, you will need to pick and create the most optimal system to back up your data. It’s wise to get this checked out with a professional. They have the required expertise to suggest the most secure system to back up your books of account.

Conclusion

Another extremely effective way to back up your data on QuickBooks is using cloud technology in the form of QuickBooks Hosting. Cloud Accounting is a revolutionary step in accounting and data storage. With this advancement, your data is kept safe and stored in the accessible cloud. This keeps it safe from data losses or breaches. Only authorized personnel can access the accounting data store from anywhere in the world.